tax shield formula uk

Will receive as a result. The tax shield Johnson Industries Inc.

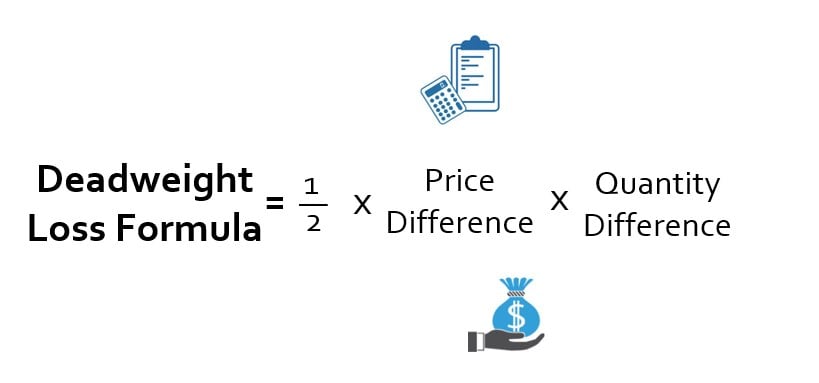

Deadweight Loss Formula How To Calculate Deadweight Loss

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. For example if an individual has 2000 as mortgage interest with a tax rate of 10. Web The maximum depreciation expense it can write off this year is 25000.

Web The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. This companys tax savings is equivalent to the interest. Or the concept may be applicable.

The applicable tax rate is 37. For instance if the tax rate is 210 and. Suppose the Taxable Income is 1000 and deductible expense amount to.

Net Income 10 million 2 million 8 million. Taxes 8 million 20 16 million. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

Interest Tax Shield Interest Expense Tax Rate. Web In this video on Tax Shield we are going to learn what is tax shield. Web Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues.

For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the. Taxes 10 million 20 2 million. Web The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation.

Web Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Web The tax rate considered in the example is 40. Web formula shield tax uk.

Web A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Web Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Interest Tax Shield Formula.

What is the formula for tax shield. Tax Shield Amount of tax-deductible expense x Tax rate. TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest.

The Amount of Tax to be paid is calculated as. 1 For example because interest on debt is a tax-deductible. Web Tax Shield.

On the other hand if we take. Net Income 8 million. Web The formula for calculating the interest tax shield is as follows.

Web To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would. Tax shield formula uk. Web Tax Shield formula.

Web Interest Tax Shield Example.

Annual Percentage Rate Apr Formula And Calculator Excel Template

Net Debt Formula And Calculator Excel Template

Native Remedies Sweat Less Natural Homeopathic Formula For Excessive Sweating 810845017336 Ebay Native Remedies Excessive Sweating Homeopathic

Reserve Ratio Formula Calculator Example With Excel Template

Loss Ratio Formula Calculator Example With Excel Template

The Chant Of Light By Marion Montgomery

Fixed Charge Coverage Ratio Fccr Formula And Calculator Excel Template

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

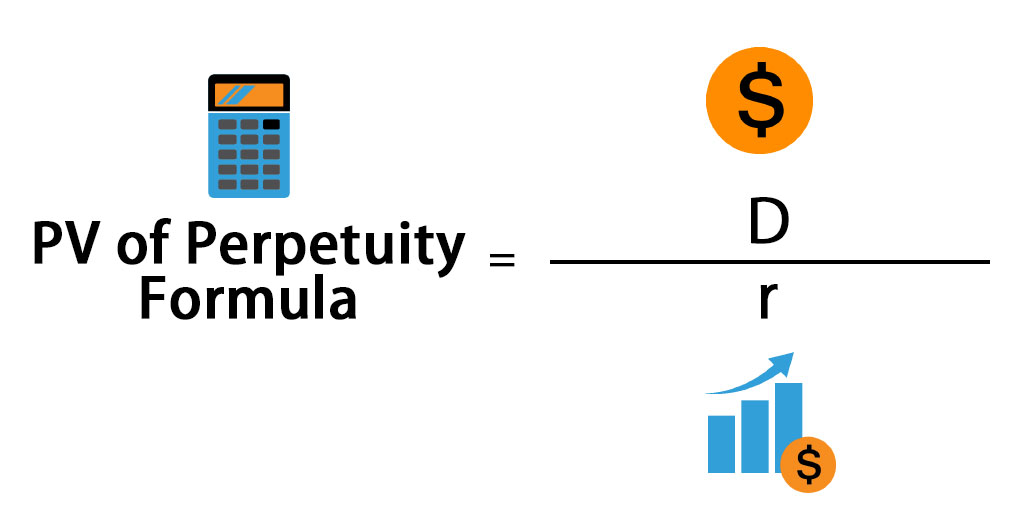

Perpetuity Formula Calculator With Excel Template

Wacc Formula Definition And Uses Guide To Cost Of Capital

Unlevered Free Cash Flow Definition Examples Formula

Salvage Value Formula Calculator Excel Template

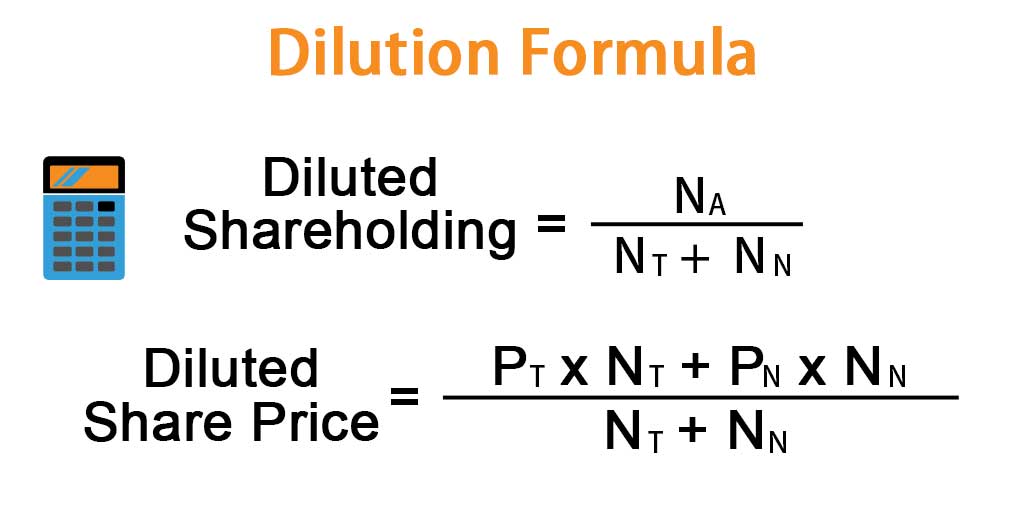

Dilution Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)