work opportunity tax credit questionnaire social security number

Work Opportunity Tax Credit WOTC Frequently Asked Questions. Social security number.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. WOTC is authorized until December 31 2025 Section 113 of Division EE of. The forms require your identifying information Social Security Number to confirm who you are.

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers. Its asking for social security numbers and all. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our websites chat box this one from a new hire. If so you will need to complete the questionnaire when you apply to a position or after youve been hired. Its called WOTC work opportunity tax credits.

Posted on May 9 2018 January 15 2018 by WOTC Blog. There are two sets of frequently asked questions for WOTC customers. New hires may be asked to complete the wotc.

If the employer believes that based on the information provided on the IRS Form 8850 the job applicant meets the requirements for one or more target groups complete all. Felons at risk youth seniors etc. Check here if any of the following statements apply.

18 Jan 2022. A company hiring these seasonal workers receives a tax credit of 1200 per worker. For the work opportunity credit.

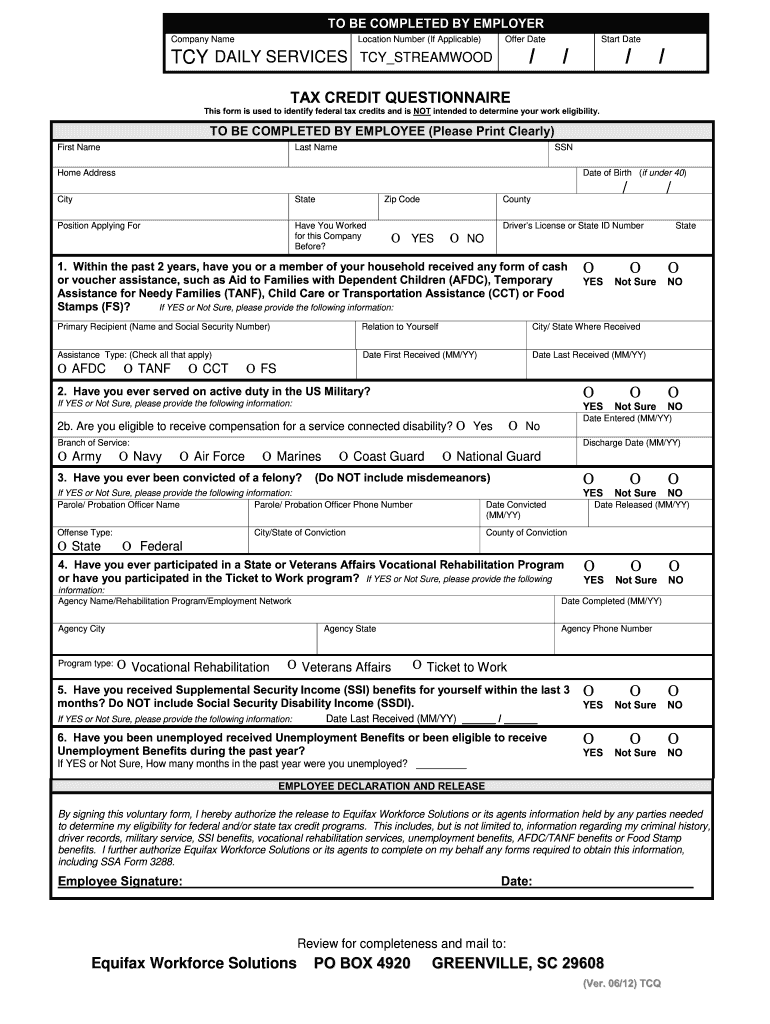

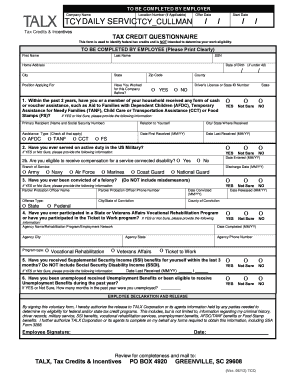

TAX CREDIT QUESTIONNAIRE Company. If so you will need to complete the questionnaire when you. Work Opportunity Tax Credit Questionnaire.

Companies hiring long-term unemployed workers receive a tax credit of 35 percent of. If you do not supply the social security number on the application you will likely have to make a trip to the company to fill it in if the employer wants to offer you a job. After the required certification is secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes.

Completing Your WOTC Questionnaire. My mom wont give me my social security number because she doesnt trust the site. The WOTC is a federal tax credit available to employers who invest in American job seekers who.

Updated on September 14 2021. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The tax credit itself is equal to 25 or 40 of a new employees first-year wages up to the maximum for the target group to which the employee belongs.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups. Make sure this is a legitimate. Are employees required to fill out WOTC form.

Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the. Some companies get tax credits for hiring people that others wouldnt. Certifications to employers seeking a Work Opportunity Tax Credit WOTC.

I dont feel safe to provide any of those. Work opportunity tax credit questionnaire required. An employer may claim a credit equal to 40 of the eligible employees qualified wages if the eligible worker works at least 400 hours during the first year of employment.

Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit. The owners of the site is Walton management services and it says our company is participating in a. Johnson Service Group Inc Position.

ABC COMPANY participates in the federal. Work opportunity tax credit questionnaire required.

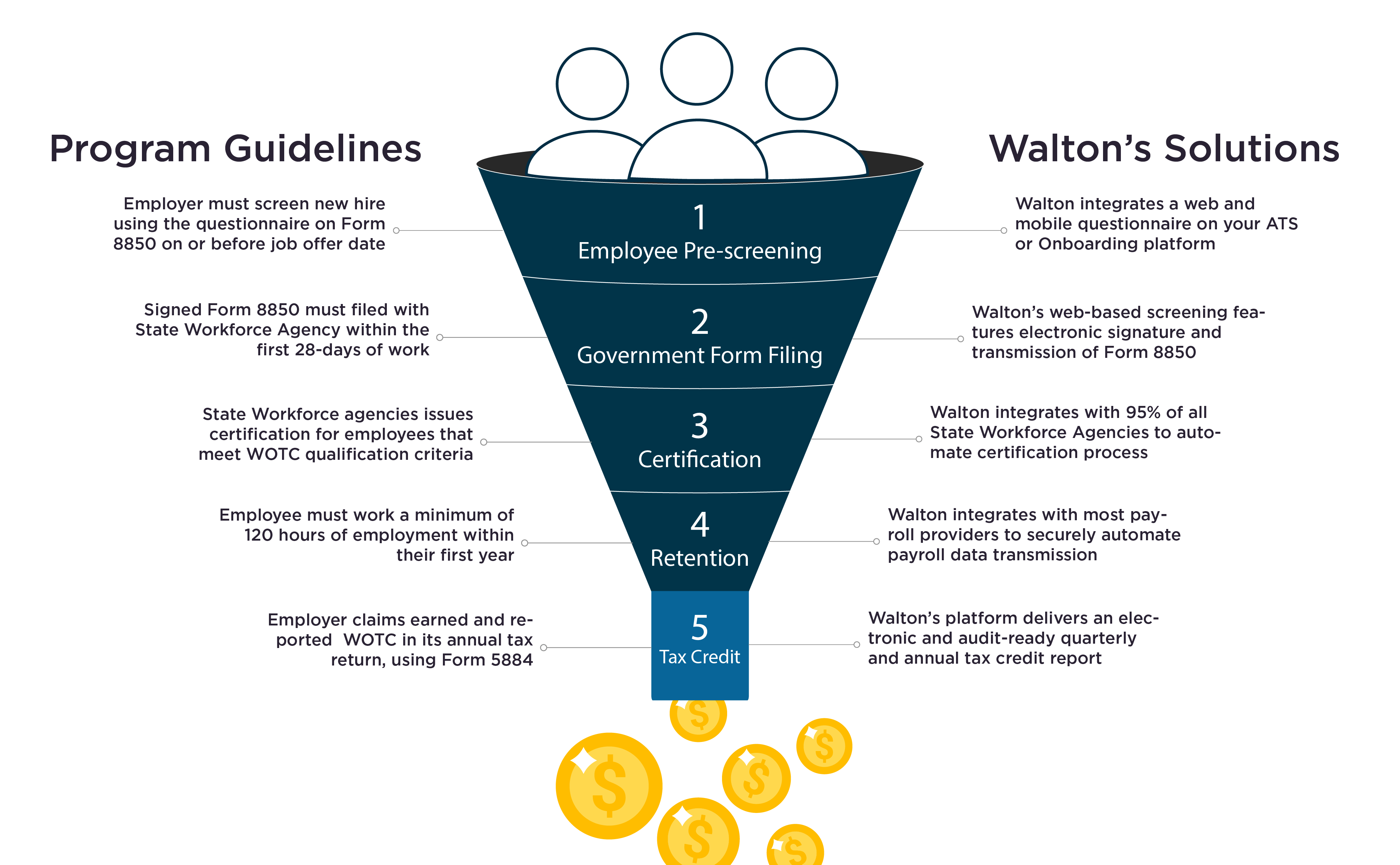

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Is Survey Engine Tax Credit Co Safe Mcnally Institute

Wotc Questions Why Is My Ss And Date Of Birth Required On Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

Wotc Form Fill Out And Sign Printable Pdf Template Signnow

Social Security Instruments International Labour Organization

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

With Wotc Timing Is Everything Wotc Planet

Form 8958 Texas Prepare And Sign Signnow

What S The Deal With Work Opportunity Tax Credit

Work Opportunity Tax Credit What Is Wotc Adp

What Is A Tax Credit Screening When Applying For A Job Welp Magazine